BBC Panorama reported in the “The Big Bank Fix” – the co-ordinated rigging of LIBOR interest rates and the role of the Bank of England and Government in covering up the whole sordid affair.

The rigging of LIBOR, a hitherto obscure financial benchmark burst into the global conscious in June 2012 with Barclays fined £290m by US and UK regulators, precipitating the rapid departure of CEO & investment banking titan Bob Diamond.

LIBOR quickly became a touchstone issue for greed, corruption & excess in the City of London.

Panorama made for gripping viewing, served up fantastic investigative journalism that drew the public into an otherwise dry subject matter, but as Frances Coppola noted in a recent blog post – for those who’ve been closely watching LIBOR rigging proceedings, its content revealed little constituting fresh news.

The exception being the public broadcasting of details of Barclays internal investment vehicle – The “Ricardo Master Fund” (RMF) which was secretly established by Barclays to benefit from falling interest rates from 2007 – 2009 – ensuring bank Executives reaped enormous profits, as they enacted the BoE’s 2008 instructions to ‘low-ball’ (lower) LIBOR rates.

The Ricardo Master Fund, which initially ran unsuccessfully as a hedge fund for external clients, was re-launched by Barclays on 01 March 2007, with the bank investing $100m in RMF as the sole beneficiary of the Cayman Islands registered entity.

Mark Dearlove, recruited by Bob Diamond to the bank, is described as the pioneer member of the RMF, instrumental in its setting up, and smooth running, via Barclays Singapore Offices.

Dearlove who features in the Barclays ‘lowballing’ recording aired by Panorama was also the Director for Barclays Capital Strategic Advisers Limited (BCSA) which was RMFs investment manager, whilst also the line manager for Barclays £Sterling and $USD Libor submitters.

It is alleged in court documents that BCSA: “existed principally, if not exclusively to serve RMF and its Directors from time to time, including Barclays senior management: Bob Diamond, Jerry Del Missier and Rich Ricci and others.”

Public knowledge of the RMF trading strategy and the implication of senior Barclays Executives now threatens to burn through a carefully constructed firewall around LIBOR claims.

Banks previously argued there was no downward manipulation of £GBP Sterling LIBOR, but details revealed through Barclays disclosure in the case of Arthur Holgate & Sons featured in Panorama contradicts the argument deployed by the banks to contain the scope of legal claims for derivative products such as swaps and interest rate hedging products (IRHPs) widely ‘mis-sold’ to clients in the UK.

The RMF appears to be the end product of a Barclays conspiracy to trade upon market sensitive, insider information, provided by Government and the Bank of England.

Barclays then covered-up the existence of the Cayman Island registered RMF, withholding key evidence from enforcement agencies. Bob Diamond appears to have to mislead Parliament over prior knowledge of low-balling, when infact – Diamond was a Director of RMF and profiting from it.

In relation to the Ricardo Master Fund allegations Alex Cobham – Director of the Tax Justice Network said:

“If the allegations stand up, this wouldn’t just be a $100m corruption case, or a body blow for Barclays’ reputation. The most obvious implication is the explosion of the claims that banks have been ‘punished enough’ since the financial crisis. Clearly, the banks haven’t even been investigated enough.

The apparently unregulated and anonymous Cayman hedge fund structure (RMF) shows, once again, the results of a regulatory race to the bottom which left policymakers wilfully blind, not only to the systemic risks but also to the risks of corruption and practices of market-rigging.”

Details of the RMF, along with Barclays strategy to profit from the lowballing of Sterling LIBOR are set out in a 60 Page Particulars of Claim High Court document, which resulted in an out-of-court settlement by Barclays, in favour of the Holgates for a non-disclosed sum in 2016.

Holgate vs Barclays01022016_2bAs the LIBOR scandal broke in 2012, Barclays issued veiled warnings claiming the Bank of England was secretly influencing Libor rates.

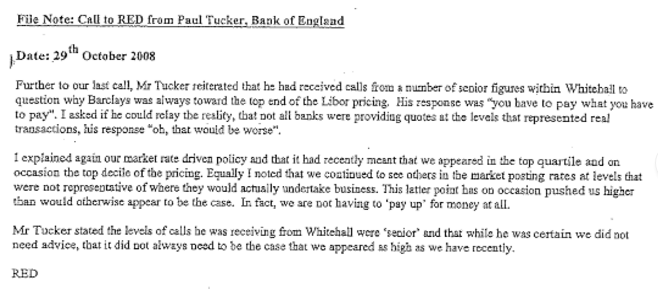

Diamond’s 2012 submission to the Treasury Select Committee included this file note recording a phone call between Diamond (RED) and Paul Tucker, the Deputy Governor of the Bank of England.

Whilst a transcript of the call between senior Barclays manager, Mark Dearlove, instructing Libor submitter Peter Johnson, to lower his Libor rates was published previously – the newly unearthed audio recording, broadcast to the nation with the palpable tension of an act you sensed both men knew was illegal – made for gripping television.

Peter Johnson is now serving four years in jail. The Serious Fraud Office (SFO) only began questioning Mark Dearlove (who personally stood to profit from lowballing via RMF) regarding LIBOR rigging in January 2017.

Given the severity of the accusations leveled by the BBC at the Bank of England, that Deputy Governor Paul Tucker, instructed or pressured by senior Government and Whitehall figures (thought to be Alistair Darling via Chief of Staff Sir Jeremy Heywood or Treasury’s Sir Nicholas Macpherson who served Gordon Brown) – the political response has thus far has been muted.

Shadow Chancellor John McDonnell with Conservative Chris Philps on the Treasury Select Committee are demanding an urgent enquiry to discover what went on and who knew what?

Labour have written to Philip Hammond demanding answers, but the Chancellor has gone underground, and will not field parliamentary questions until Tuesday following Easter recess.

What The Bank of England Knew?

Mervyn King, then Bank of England Governor received an email from US Treasury Secretary Geithner in June 2008 with concerns about the integrity of the LIBOR benchmark, and a list of recommendations regarding how to improve it.

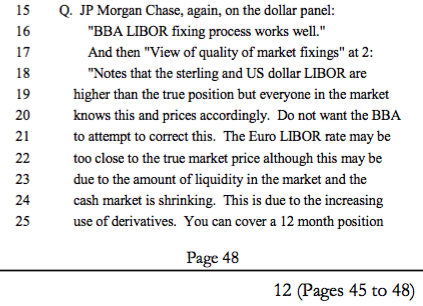

On 16 April 2008, BBA CEO Angela Knight convened meeting with a $USD Libor submitters where banks were pressured to increase their Libor rates significantly, to reflect borrowing costs.

By July 2 2008, Sir Mervyn King, BoE governor, was “broadly content” that an accommodation had been reached, yet was irritated by the BBA’s approach.

In a note scribbled by hand on a memo, King said: “I would like Mr Tucker to meet with Angela Knight, head of the BBA, to impress upon her the need for greater energy in BBA’s response.”

Little was done by the BBA to act on this request. Angela Knight, the former Conservative MP and CEO of City lobby group The British Bankers Association (BBA) would claim in December 2008 that LIBOR “could be trusted as a reliable benchmark” and was the envy of the world.

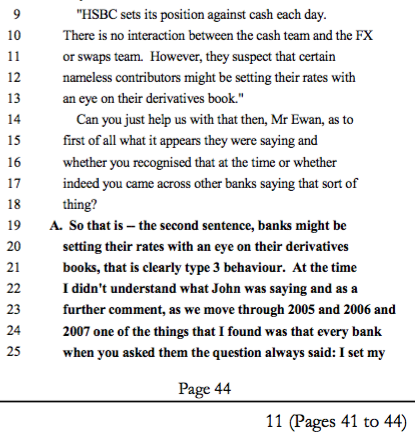

Court evidence in the Contagoulas and Reich LIBOR retrial shows the Bank of England received information via the British Bankers Assoc between 2005 and 2007 that £Sterling and $USD Libor panel banks knew rates were 3 to 4 basis points above where banks could realistically borrow, and that banks manipulated submissions to suit derivatives trading positions.

The Bank of England did nothing with the BBA information aside from recommending the BBA widen the panel to corporates and hedge funds. The pair of Barclays traders were acquitted of criminal conspiracy charges at re-trial.

Failure of the Bank of England and US Federal Reserve to ensure the integrity of LIBOR benchmarks would have disastrous results for UK and US taxpayers.

Timothy Geithner was forced to concede that the bank bailouts and US TARP program to rescue the financial system, were undertaken with rates rigged by these same banks for profit. In the UK, Lloyds was fined for rigging the repo rate linked to its own bailout package.

Angela Knight was taken to task by C4 in this car crash interview with veteran presenter Jon Snow in 2012

Angela Knight suffered no professional consequences for her role in manipulating and defending the LIBOR benchmark, and was promoted to a role in HMRC by George Osborne in 2015.

The Role of the Money Brokers

Less well known the bankers (“traders”) and regulators in the LIBOR scandal was the significant role of inter-dealer money ‘brokers’.

Firms such as ICAP, Tullet Prebon, Tradition and RP Martin who arrange (broker) trades related to interest rate derivatives for banks, hedge funds and large corporate clients. [Read more about what money brokers do here].

Angela Knight, alongside her BBA role, sat on the board of money Broker Tullet Prebon, whose brokers stood accused of submitting false LIBOR submissions to benefit traders at the banks.

David Enrich, author of ‘The Spider Network’ observes: “at the heart of the brokerage industry were a number of simple equations. For every trade a broker arranged, his firm pocketed a commission – generally ranging from several hundred dollars, to several thousand” Of that, the individual broker stood to pocket around 30% in the form of quarterly bonus payments.”

On some trades however, commissions were far larger. Commissions on LOBO loans (which were linked to the rigged LIBOR rate) sold by banks to hundreds of town councils up and down the UK generated “super profits” for banks, and commissions of £20,000 to £100,000 per loan.

Alongside Knight on the Tullet board sits Michael Fallon, the Conservative MP, now Defence Minister – who was coincidentally a member of the Treasury Select Committee in charge of regulating City firms involved in rigging LIBOR.

Michael Fallon’s dual role as poacher and gamekeeper of financial services regulation was a clear conflict of interest. Yet in Britain, where standards in public life have been deregulated to the point of non-existence, such practices remain the norm.

Sardines and Cellphones – How LIBOR Rate Volatility Profits Middlemen

In an economics study conducted between 1996 and 2001, the authors conducted daily price surveys of sardines from 300’ fishing boats as cellphones were rolled out across Kerala India.

The Keiser Report covered the research to demonstrate the disintermediation of the sardine robbber barons of Kerala, as cell phones introduced free access to accurate and timely price information, removing speculative middle men from transactions, stabilising sardine prices.

See from the chart below how dramatically prices stabilised as fisherman gained access to live market information.

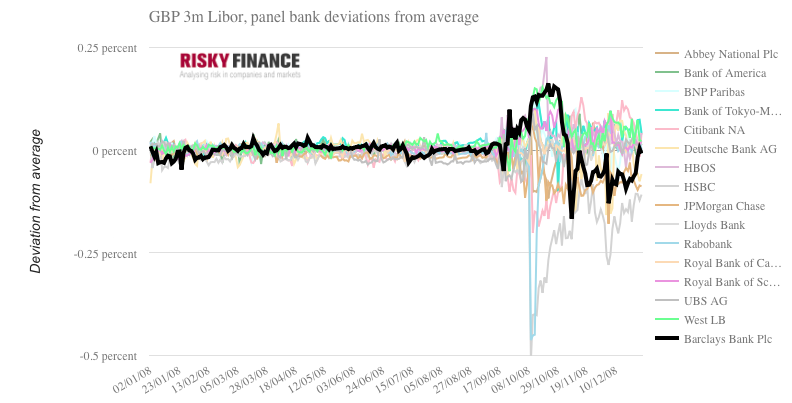

In the image below via Nick Dunbar at Risky Finance (registration required), LIBOR interest rate markets diverge during the 2008 financial crisis, as the Bank of England intervenes to lowball rates – creating market volatility, the inverse scenario to the introduction of cell phones in Kerala.

Barclays, rather than keeping LIBOR submissions high to reflect its true borrowing costs was marking its submissions to its derivatives book /RMF leveraged to profit from falling LIBOR.

Barclays gig was to ramp up LIBOR submissions as high as possible, then having bet the house, plunge them as fast as possible maximising the rate spread. Compared to the 16 Sterling LIBOR panel banks operating in October 2008, Barclays submissions dropped like a stone from within the 3 highest in pack, to within the 3 lowest.

In 2007/08, we transitioned from relatively stable LIBOR markets, with significant volumes of transactions between institutions enabling price discovery, to a panicked and illiquid market, with no price discovery, where central banks and LIBOR panel banks had access to inside information, which smaller banks and corporate and SME counter-parties to trades lacked.

LIBOR rates became more volatile in October 2008, but crucially, only the 16 Too Big To Fail LIBOR panel banks knew what was about to happen to interest rates, along with regulators at the Bank of England.

Informational asymmetry which resulted in smaller institutions and counterparties being fleeced.

Rather than producers benefiting from stable prices, volatility and inside information ensured they got fleeced by banks offering structured loans, hedges and swaps to guard against volatility, whilst failing to disclose downside risks to their clients.

The Balance Sheet Impact of LIBOR Rigging On Banks and SMEs

Steve Middleton is an Independent Financial Advisor who acts for SME business victims in court and bank negotiation/ redress cases involving hedging and swaps. He told me:

“Despite numerous investigations into the banks rigging of LIBOR and the FX markets the FSA /FCA have failed to consider the critical damage done to many UK businesses locked into Interest Rate SWAPs as Counterparty’s to the banks on LIBOR linked contracts.

Many SME’s were induced to buy SWAP contracts and ‘fix’ a rate to ‘protect them’ against ‘future interest rate increases’, often via complex trading contracts.

When rather than increasing, rates reduced, the difference between the fixed rate being paid by the SME and the variable rate (and future forecasts for such) defined the profit in the trade contract, this value known as the Mark to Market value (MTM) was a balance sheet asset for the banks involved.

From 2004 on the banks began to rely on International Financial Reporting Standards (IFRS) accounting practices and IAS. 39 which was a measure for valuing Financial Instruments such as SWAPs and related loans. From this point going forward the Treasury or Markets teams became the main provider of funds for business loans, often by supplying the funds to a ‘front end’ lending bank i.e. BarCap to Barclays, HBOS Treasury to Bank of Scotland, RBS Markets to NatWest etc.

This type of arrangement had many benefits as the interbank lending required less default cover and the Treasury arm could effectively manipulate the value of the loan arrangements, via the use of credit ratings and ‘fair value’ accounting. The Treasury arm would then run the loan book as an investment portfolio and ‘slice and dice’ SME loans alongside Blue Chip and Senior debt in Collateralised Debt Obligations (CDO) and similar instruments to raise funds in the markets.

Often via the use of CDO wrappers and loan notes, the underlying SME’s poor to average grade credit deals would be sold on as double or triple A rated debt as if it were the bank itself.

The banks utilised SWAPs and their underlying ISDA contract basis, alongside their standard legal charges as a method of securing the SWAP trading liabilities of the SME to the individuals or company’s assets usually property or land, this was almost always done without the SME’s knowledge. The banks would then leverage the trade value (MTM) numerous times to fundraise, relying on the full value of the SME’s secured assets for its own purposes.

When rates started to decrease and many businesses could not cope with the higher interest rate payments they would seek to exit the higher fixed rate they were paying and at that point many, for the first time, became aware of the exit penalties or ‘break costs’ to terminate the trade. The termination costs being based largely upon the MTM value, or in other words the banks projection of its future profit in the trade, could be as much as 50-60% of the initial loan value.

From 2007 on, without notifying their SME Counterparty’s, the banks began denominating the SWAP deals in USD and therefore without realising it many small businesses were exposed to a further currency conversion risk in the SWAP trade liabilities. The majority of banks relied on European bases outside of the UK to passport in their trading platforms, therefore also circumventing client money protection rules.

Whilst the FCA set up a Review to consider the mis-selling of such products, the Review process focussed on the cash flow losses to the businesses, not the balance sheet damage and indeed the FSA’s own review into its failings in the LIBOR rigging focus almost entirely on the ‘profit and loss’ of the rigged trading, rather than the substantial ‘rigging’ enhancement (depending on the size of the bank tens to hundreds of £B’s) the banks received to their balance sheet.

Many SME businesses failed due to their inability to be able to pay the break costs and exit the deals for lower rates. It is now becoming clear that many such SME’s with LIBOR deals, were trapped in SWAPs by artificially enhanced break costs; based on LIBOR Lowballing, which clearly both the Bank of England and the FSA were aware of.

I would suggest that any victim of a LIBOR SWAP or Fixed Rate Loan mis-sale has a strong position in demanding that the FCA reopen their cases and properly assess the damage to their business based on the balance sheet rigging that LIBOR provided to the major UK banks at their expense!”

Keiser Reports Stacy Herbert observes: “our economy has gone backwards from an era of tally sticks where we have true price discovery, to an era today with volatile interest rates and a few insiders have all the information.”

ICAP – King Amongst Middlemen

Chief amongst the insiders and middle men who benefit from a potent mix of volatile markets and insider information is ICAP – the worlds largest inter-dealer broker, founded in 1986 by former Conservative Party Treasurer and leading Tory donor – Michael Spencer.

ICAP broker markets in interest rates swaps and derivatives futures trades linked to commodities like oil, where counterparties to the deals need to fix prices by taking out hedges or swap agreements to guard against volatility in financial markets to maintain stable input prices.

Spencer is on the record stating ‘Volatility is good for business” – ‘We don’t trade as principal, so by the greatest good fortune we don’t own any of the toxic stuff and volatility has given a material boost to volumes and our earnings performance has strengthened.”

The 2013 ruling against ICAP issued by the US Commodities Futures Treading Corporation (CFTC) confirms ICAP both sought to, and successfully influenced, Yen LIBOR submissions made by the panel banks:

“The Order finds that almost all of the Yen LIBOR panel banks received the Suggested LIBORs, and several relied on them in making their Yen LIBOR submissions, particularly during the financial crisis of 2007-2009.

According to the Order, the ICAP brokers referred to the panel bank submitters as “sheep” when they copied the Yen cash broker’s Suggested LIBORS. In fact, the Order finds that at least two banks’ submissions mirrored the Suggested LIBORs up to 90% of the time.”

“ICAP and other inter-dealer brokers are expected to be honest middlemen,” said David Meister, the CFTC’s Director of Enforcement. “Here, certain ICAP brokers were anything but honest. They repeatedly abused their trusted role when they infected the financial markets with false information to aid their top client’s manipulation of LIBOR.

ICAP received a £55m corporate fine for rigging Yen LIBOR by authorities, yet its individual brokers were acquitted at trial.

The obvious question that remains to be asked is did ICAP employ similar tactics in using its “Daily run through” emails to banks in order to manipulate bank submissions on other frequently traded LIBOR currencies such as £ and US $..?

THE FSA – The Fundamentally Supine Authority

Absent from the media and political critique of LIBOR rigging is role of the financial regulator, The FSA and its former CEOs Lord Adair Turner who departed to work for George Soros, and Sir Hector Sants, who left the FSA to work for Barclays, having earlier refused to investigate LIBOR rigging.

Adair Turner observed that: “the FSA did not respond rapidly to clues that lowballing might be occurring.”

Upon Hector Sants departure in 2012, Sants said: “The FSA, myself and Barclays are aware of some ongoing cases between the bank and regulator that I was involved in initiating. I have made it clear I will not be involved in those cases.”

The Head of Enforcement at the Financial Services Authority (FSA) Tracey McDermott said with regard to Barclays LIBOR manipulation:

Who were the “other market participants” that McDermott at the FSA are referring to?

The Victims of LIBOR Rigging

The victims of Barclays ‘low-balling’ of LIBOR rates featured in Panorama were a family from Cumbria who borrowed £3m from Barclays to expand a caravan park business.

Arthur Holgate and Sons were ultimately bankrupted when Barclays forced them to take out an interest rate swap in 2007 to “hedge” against interest rates rising. Like the small business customer in the “Swaps Film” below, the Holgates were never warned if rates fell, the repayments and hidden contingency charges would likely cripple their business.

The Particulars of Claim from the Holgates December 2015 case against Barclays (which was settled out of court in 2016 by Barclays for a non-disclosed sum) set out the Caravan Park owners claim against the bank – through painstaking research off the Holgates own backs.

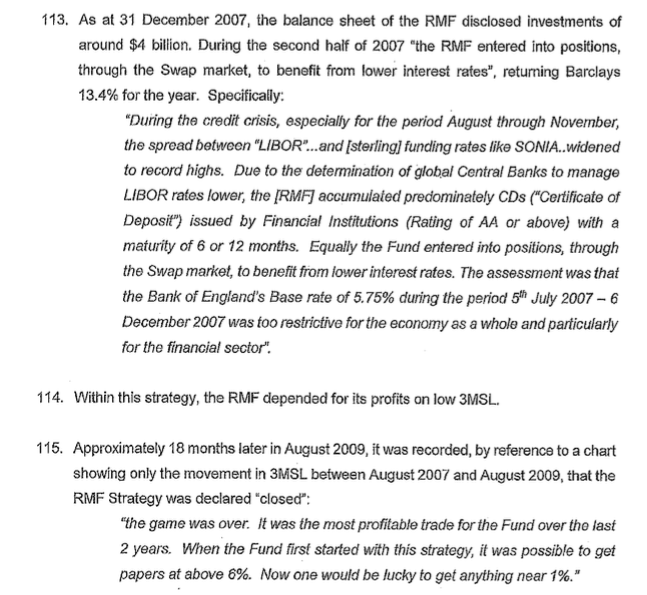

Set out in the Holgates particulars of claim – based upon fiercely contested legal disclosures from Barclays are the details of Sterling LIBOR ‘lowballing’ which is alleged to have occurred between August 2007 and August 2009 – to benefit trades placed by the Ricardo Master Fund which was leveraged to benefit from falling £LIBOR.

The Holgates are thought to have claimed around £20m in damages from Barclays. A lot of money for the average person, yet relatively small fry for the larger institutional victims I have spent the last 5 years researching.

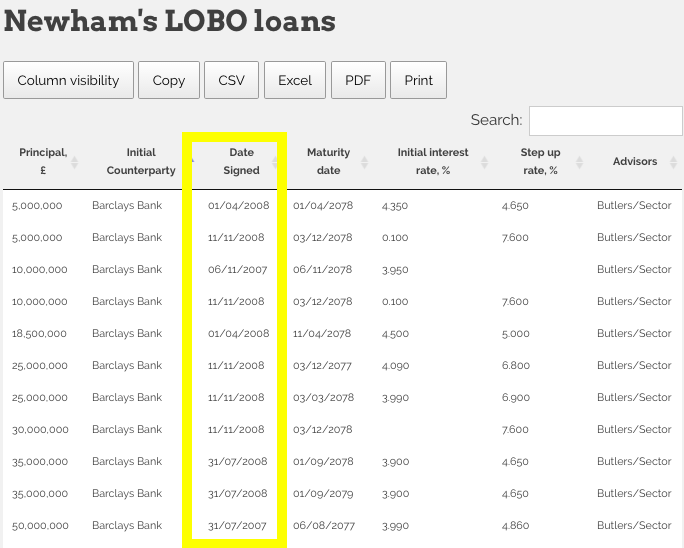

Chief amongst these institutional victims is the London Borough Newham, which borrowed a staggering £248.5m in LOBO loans from Barclays, featuring a derivative known as a ‘Bermudan Cancellable Swap’ linked to £GBP Sterling LIBOR, which the banks conspired to rig.

Of the 11 Barclays LOBO loans contracts, all were signed by Newham during the 2007 – 2009 crisis period where the Ricardo Master Fund was trading to benefit from the lowballing of £LIBOR. Two loans were signed in 2007, and 9 loans in 2008, both immediately prior to, and following, the Bank of England’s lowballing instruction.

Barclays RMF strategy was to borrow “commercial paper” jargon for bank “certificates of deposit” (CDs) for 6-12 months, paying approximately 6% interest – armed with inside information from Paul Tucker at the Bank of England, to amass a position that would profit as rates were driven down by the LIBOR panel banks and the Bank of England.

The Holgates Particulars of Claim states:

The worst offending variety of Barclays LOBO loans sold to Newham known as “range LOBOs” were sold on the basis of a bet that LIBOR rates were likely to remain with a range of 4.0% and 6.2% interest.

If LIBOR stayed within the range, Newham would pay around 4% interest. If LIBOR strayed outside the range, Newham would pay nearly double that rate. 7.6% interest.

Newham not only lost the bet, they were actively cheated out of taxpayer money by Barclays lowballing LIBOR.

900 people have now signed a petition demanding Newham take RBS and Barclays to court.

#Newham gambled £95m on @Barclays Range #LOBO contracts. Pay 0.1% interest if #Libor > 4%, 7.6% if <4%. Newham lost pic.twitter.com/aMvxn6F9ZF

— Nicholas Dunbar (@nicholasdunbar) August 5, 2015

900 people have now signed a petition demanding Newham take RBS and Barclays to court.

Since 2009/10 with a combination of low-balling of £LIBOR by the banks, and Bank of England QE, base rates have plummeted to 0.25% with LIBOR rates significantly below the terms of loans. Newham are paying the banks £7million more in interest each year than they should be.

Evidence disclosed by Barclays to the Holgates shows that by August 2009 when Barclays closed out the RMFs sterling positions, the fund had amassed a £100 million profit through abnormally low 3 month Sterling LIBOR.

The implications of these most recent findings for Barclays are sobering, not least because:

- Mark Dearlove who issued the instruction to Peter Johnson to lower Barclays libors is a Director of the RMF, recruited by Bob Diamond, responsible for RMF investment strategy.

- Evidence related to the Cayman Island registered Ricardo Master Fund was withheld from the FSA, SFO, CFTC and DoJ by Barclays, and only surfaced through court evidence in 2013 after Guardian Care Homes forced disclosure.

- Peter Johnson was jailed for 4 years for his role, whilst Dearlove who profited from the moves was only questioned by the SFO in relation to LIBOR in January 2017.

- Bob Diamond swore before Parliament he knew nothing about LIBOR lowballing before 2012, despite being Director of the RMF fund geared to profit from 2007-09 lowballing.

The obvious implication is that Barclays and Bob Diamond not only misled Parliament, but deliberately set out to pervert the course of justice, and to deceive prosecuting authorities by failing to disclose the existence of a Cayman Island registered hedge fund – in the hope the Caymans secrecy laws would protect them from the full .

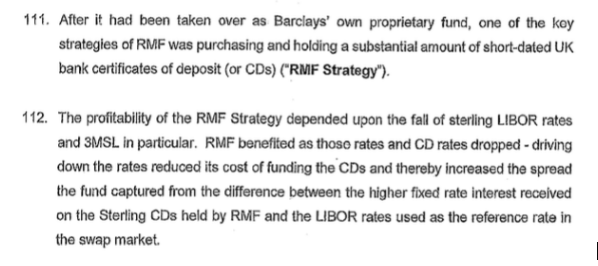

We now need a judicial inquiry, where witnesses are legally compelled to attend and give evidence under sworn oath and the threat of perjury to find out precisely what went on, who knew about it, and why the truth has been covered up for so long whilst junior traders were fitted up to rot in jail.

Posted in Uncategorized

A powerful piece of analysis, Joel. You’ve put most mainstream media journalists to shame.

Well done.