On Thursday 22 September, as Liverpool was gearing up to host the Labour 2016 Conference, Liverpool City Council’s Audit and Governance Committee met to scrutinise a series of big ticket financial decisions made by the Council, and the progress of external auditors in running over the fine print of the councils annual accounts.

On the meeting agenda, which can be viewed here, councillors were to consider the findings of the council external auditor – Grant Thornton, who had been scrutinising the draft 2015/16 annual accounts.

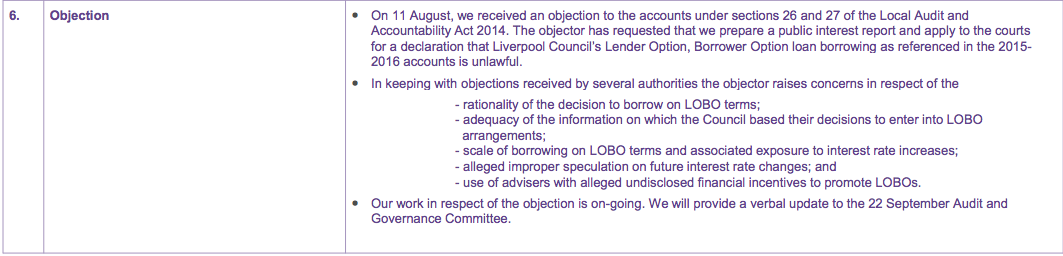

Debt Resistance UK were interested in the meeting because Liverpool City Council – which has borrowed £170 million in LOBO loans from the banks is one of 24 local authorities around the country where residents have lodged legal objections against the council because of its excessive and risky borrowing from banks.

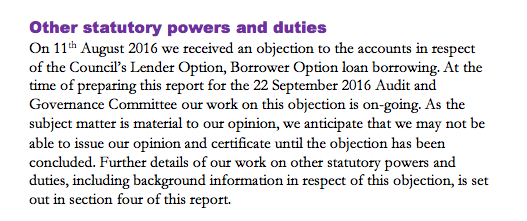

The citizen objection to Liverpool’s LOBO loan borrowing is mentioned on page 7 of the Grant Thornton report, which says:

During the audit meeting, which was attended by Robin Baker – the Audit lead for Grant Thornton, at approximately 12 minutes, 40 seconds – you can hear Liverpool Finance Director Becky Hellard comment on the value for money of the LOBO loans taken out by the Council.

Finance Director Hellard can be heard claiming:

“And then on the LOBO one, … we remain confident that the agreements that were entered into in the previous financial years … did represent good value for money. They were at lower rates than the PWLB loan board offered at that time and we have got the ability to leave them at any stage without any penalties. So whilst this is all going on, I want to reassure members that we are actually not concerned about them as professionals.”

If Director Hellard wants to label herself a finance “professional” then she is either an incredibly incompetent, or poorly advised one…

Rather than being “able to leave the loans at any stage without penalty” as Becky falsely suggests, LOBO loans are subject to punitive “break penalties” which keep the Council locked into paying higher interests rates and unable to refinance, as interest rates have continued to drop since 2009.

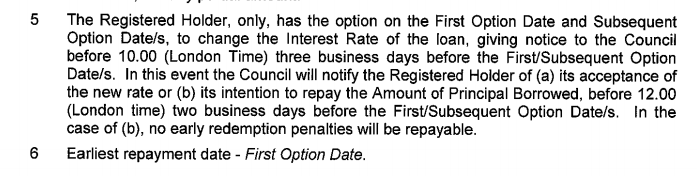

Debt Resistance UK pulled up a sample of Liverpool’s 8 LOBO contracts – and this is what the contracts state regarding early repayment of the loan contracts by the Council.

Clause 5 confirms that the bank (or registered holder) has the option at regular intervals to increase the interest rate payable on the LOBO loan. The Council on the other hand has the option to repay the loan without penalty, but crucially – ONLY IF the bank first choose to increase the interest rate.

The reality of current market conditions is that no bank would ever choose to increase the rate payable on a LOBO now, when they have the council currently paying 4.9% and prevailing market interest rates are just 1.5-2% – meaning a profitable 2%+ interest rate premium being paid by the council to the bank.

It is clearly in the banks interest to keep the Council locked into paying the higher rate for the next 50 years, and not to allow the Council to refinance the loan today at 1.5-2% interest.

As the contract states in section 5 (b) it is only if the bank increases the interest rate, that the council can repay the loan without “early redemption penalties,” and therefore in any other circumstance break penalties WOULD apply.

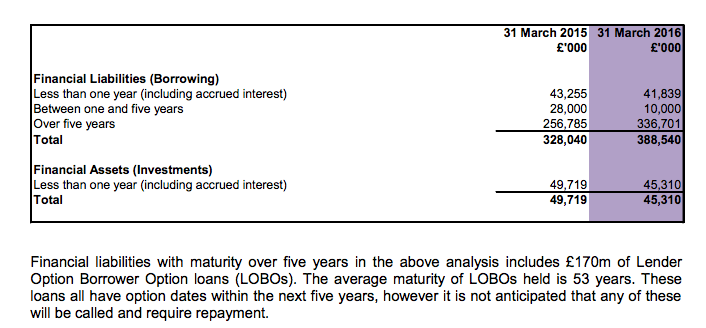

The Council’s own annual accounts (see screenshot below from page 88 of annual accounts) state: “these [LOBO] loans all have call options within the next 5 years, however it not anticipated that any of these will be called and require repayment” – so if the loans are not expected to be called by the banks, any early repayment by Liverpool will be subject to a break penalty.

Finance Director Becky Hellard is wrong – and has either never read the loan contracts, or has set out to mislead the Audit Committee.

How much are the early redemption penalties on LOBO Loans you might ask? – well on a sample of LOBO contracts analysed by Abhischek Sachdev of Vedanta Hedging in evidence to the 2015 DCLG inquiry on local government bank loans, exit penalties on LOBO loans were found to be around 90% of the loan face value/ principal amount, compared to an average of just 30% on a comparable loan from central Government.

If you took Liverpool’s £170 million of LOBO loans, and asked the banks for the cost of repaying them today – the total cost would be around £320 million, nearly twice the amount originally borrowed.

At Wirral Council – the cost of repaying LOBO loans with a face value of £100 million is a staggering £259 million!

Rather than being allowed to “repay the loan anytime – without penalty” as she falsely claims, Finance Director Becky Hellard would find herself searching down the back of the sofa for a spare £150 million – something no council has lying around in the context of austerity and 60% cuts to Government grant funding.

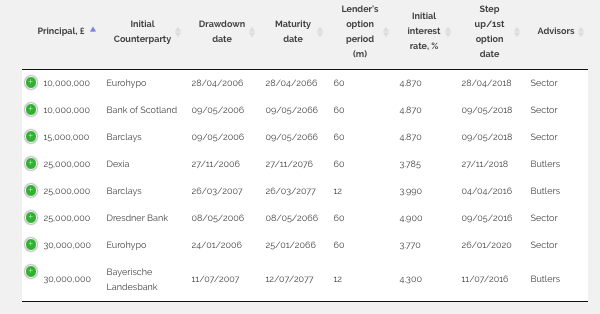

What are the interest rates Liverpool are paying on its LOBO loan debt? Well according to loan contracts sourced by Debt Resistance UK using FOIA as featured on our website, Liverpool are paying between 3.7% and 4.9% interest.

This brings us to the issue of corruption and CAPITA as conflicted advisors.

Liverpool City Councils financial advisors in the above table are Sector (part of CAPITA), who advised the Council on entering LOBO loan agreements as an “independent” “Treasury Management Advisor”.

Whilst profiting from financial advice to Liverpool council, it is a matter of public record that CAPITA were secretly taking thousands of pounds in undeclared kickback payments from the banks and brokers involved in LOBO loan trades.

In response to the following questions from objector(s)

Q: How does Liverpool City Council monitor the exit/break cost to enable early repayment of its Lender Option, Borrower Option loan portfolio and where is this shown in the annual accounts?

CAPITA responded A: “Liverpool City Council are not required to include such cost details in the Statement of Accounts”

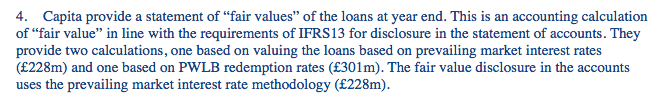

Regarding the actual value of the LOBO loans – CAPITA said:

The fact it’s the same company (CAPITA) responsible for valuing the loans with the auditor – that recommended the Council borrow via LOBO loans in the first place is apparently not worthy of mention. Seemingly in the unregulated world of council finance – theres no such thing as a conflict of interest!

The Liverpool Draft 2015/16 accounts are rather opaque when it comes to the cost and value of its LOBO loan portfolio, in a 200 page annual report, there is only one small mention of LOBOs on page 88.

What the the accounts have done is merged the £170 million of LOBO loan debt with other PFI and Public Works Loan Board debt liabilities, making a meaningful comparison of market value and interest rates for each type of debt all but impossible.

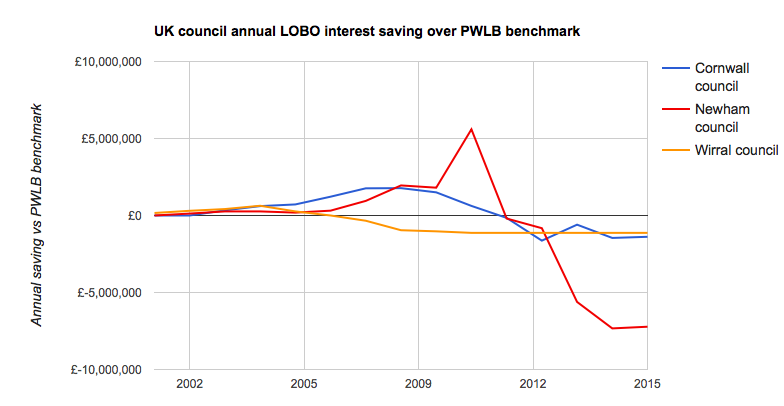

Nick Dunbar has charted interest payments on LOBO loans for several Councils for his website RiskyFinance. When you plot the interest payments for Newham, Wirral and Cornwall Council – you observe a familiar pattern – even if the extremes vary.

For the first few years during the low “teaser-rate” interest period, the LOBO loans are above the horizontal £0 cost benchmark, which represents a saving to the council relative to the cost of an alternative Government loan.

Very quickly however, as the teaser rate discount period expired, and interests rates fell post 2009, the interest rates plunge below the horizontal, meaning an annual interest rate premium being paid to the banks of between £1.5million in the case of Wirral Council to £7million per year in the case of Newham Council – a situation which could continue for the next 60 years…

Liverpool’s LOBO loans were all taken out between 2006 and 2007, which is well before Ms Hellard joined the Council in 2012/13 – so there is no question of her personal liability or involvement in the original decisions.

There are however, serious questions to be answered regarding her professional competence as Finance Director, and her previous work history.

Becky Hellard is no stranger to controversy it would seem – she left her previous role as CEO of Breckland Council under a cloud of controversy – after a series of complaints regarding her conduct saw her leave her role under a gagging clause to keep the details of her alleged misdemeanours secret from the public.

Given Grant Thornton auditors were present at the meeting where Hellard misled the Audit Committee members, we can assume they have picked up on her mistake – but just to be sure, Debt Resistance UK intend to share this blog with Liverpool’s auditors.

The matters which Grant Thornton will investigate and consider when examining the objection on LOBO Loans are set out below:

While Grant Thornton continue their investigation into the circumstances surrounding the decisions taken by Council to borrow using LOBO loans, we think Liverpool Council and Becky Hellard have a few questions to answer regarding this matter.

We have asked the Liverpool City Council press office for a response regarding the following:

- If Liverpool City Council can exit LOBO loans “anytime at no extra cost” as Ms Hellard suggests – why have LCC not refinanced its LOBO loan portfolio when current PWLB interest rates are less than 2%?

- Why did Becky Hellard mislead the Audit and Governance Committee regarding the cost of exiting LOBO loans?

- Upon who’s advice was Ms Hellard acting?

- Had Ms Hellard read the Liverpool LOBO loan contracts, prior to advising the Audit Committee?

- Is Ms Hellard appropriately qualified to act as Finance Director for Liverpool City Council and do Council retain full confidence in her judgement?

- What action will LCC and Ms Hellard now take to correct false and misleading advice given to members?

We will post the answers from Liverpool City Council onto the bottom of this blog post when and if they respond….

*** UPDATE – Response from Liverpool City Council 27/09/2016 ***

The City council’s responses to the questions you posed are:

- In making the statement relating to exiting LOBO loans Ms Hellard was referring to The Audited Statement of Accounts Report 2015/16 which states that “ any lender option to increase rates could be met by the City Council exiting the arrangement with no penalty”. This refers to a specific situation where the lender has exercised the option to increase rates or exit the loan. In this situation the City Council would exercise the borrower option and look to refinance the loan at a lower rate. An example of this is where the City Council took the borrower option on a £30m LOBO loan taken out at 3.82% over 60 years which was repaid shortly after the first option date in 2011. The saving to the City Council by refinancing the loan was £0.850m per annum for 10 years rising to £0.920m for the remaining years.

- Why did Becky Hellard mislead the Audit and Governance Committee regarding the cost of exiting LOBO loans?

Becky Hellard did not mislead the Audit and Governance Committee. Your reference is a short extract from an overview presentation of the report which covers the Audit of Accounts. That report is in Ms Hellard’s name and is explicit in the circumstances within which the City Council can exit the arrangement without penalties .It is misleading on your part to take Ms Hellard’s presentation commentary in isolation from her detailed report.

- Upon whose advice is Ms Hellard acting?

Ms Hellard is acting on her own knowledge coupled with advice from her senior finance professionals within the LCC finance function

- Had Ms Hellard read the Liverpool LOBO loan contracts prior to advising the Audit Committee?

Ms Hellard based her report and presentation on the advice of senior finance professionals from LCCs finance team who had discussed with her the significant elements of the contracts including the exit provisions

- Is Ms Hellard appropriately qualified to act as Finance Director for Liverpool City Council and do Council retain full confidence in her judgement?

Ms Hellard meets the requirements of both the job description and person specifications for the role of Finance Director at Liverpool City Council. Equally she meets fully all legislative requirements to fulfil the statutory requirements of this role. She also brings with her 15 years of experience in senior finance roles within local government .The City Council has full confidence in her judgement.

- What action will LCC and Ms Hellard now take to correct false and misleading advice given to members?

LCC does not accept that any false or misleading information has been given to members. The report clearly sets out on page 75 the detail of the exit provisions. However, for reasons of clarity only, a short note will be circulated to Members of the Audit and Governance Committee .

That concludes the responses to your specific questions .However , Liverpool City Council owes a duty of care to its employees and wishes to put on record its concern at the defamatory language used by you in reference to Ms Hellard and requests that your headline comments ‘ of incompetent , misled or corrupt ’ are withdrawn

Posted in Blog

Hi, I was at the meeting, filmed the video and made notes on what Becky Hellard said. Hopefully the below fills in some of the gaps from the 12:40 point. .

“Errm, the Authority’s passed a favourable one which has just been highlighted there around that particular issue.

Errm, and then on the LOBO one, the reason why that is is, it is you know really to be quite direct about it, the modification that you’ve got on page 75 is we remain confident that the agreements that were entered into in the previous financial years did represent good value for money.

They were at lower rates than the PWLB err Loan Board offered at that time and we have got the ability to errm to leave them at any stage without any penalties.

OK, so they you know, whilst this is all going on, I want to reassure Members that actually you know we’re, we are not err actually concerned about them as professionals, OK?”

Members = Members of Liverpool City Council (coucillors)

PWLB = Public Works Loans Board

LOBO = Lender Option Borrower Option

Page 75 refers to her report to the meeting which has this to state on the subject,

“Grant Thornton, the City Council’s auditors, has received an objection with regard to the Council’s 2015⁄16 Statement of Accounts and this has prevented them from issuing an audit opinion at the time of reporting. The objection relates to certain types of loan arrangement which the City Council has entered into. In previous financial years the City Council has taken out a number of loans which are referred to as LOBOs (Lender Option Borrowing Option). A LOBO is a loan containing a Lenders Option and a Borrowers Option. It is for a fixed period but with options for the lender to change the rate of interest (upwards) periodically within the term (LO). If the lender exercises their option then the Borrower’s Option is to accept the revised rate of interest or to repay the loan (BO). It should be noted that not all LOBO loans are the same as LOBOs may have a fixed rate of interest or predetermined steps up, down or linked to some other reference rate. Liverpool’s LOBOs are all at fixed interest rates and with options for repayment should the lender seek to increase the rate. Liverpool City Council currently has a total of £170 million in LOBO loans taken out in 2006 and 2007 – interest rates range from 3.77% to 4.90%.

The City Council, along with a number of other councils (including Manchester, Leeds, Newcastle, Wirral and 20 others) has received an objection to its accounts citing LOBOs as the cause for objection. The objection, which was made to the Council’s auditors Grant Thornton, seeks to have such loan arrangements overturned on the basis that no rational person would have entered into them. Grant Thornton are still to reply to the objection as they are awaiting guidance from the National Audit Office.

Nevertheless, Council officers have considered the objection and are confident that the agreements entered into in previous financial years in fact represent good value for money as the interest rates were lower than equivalent PWLB loans of the period and any lender option to increase rates could be met by the City Council exiting the arrangement with no penalty. The City Council took out LOBOs as part of a treasury management strategy devised to maximise savings from the pending Housing Stock Transfer which took place on 1st April 2008. This strategy was to reduce PWLB borrowing to a level equivalent to the amount of HRA debt that was to be paid to the PWLB by the Government (DCLG). This resulted in the Council’s high rate PWLB loans (some over 10% interest payments) and equivalent costs (premiums) being paid off by the Government. The other effect was to reduce the Council’s average borrowing rates of interest thereby making savings on interest costs. The strategy was carried out and the benefits to the Council were the payment of £560.5 million principal and £174.5 million premiums by DCLG to PWLB and estimated interest savings of £40 million over the life of the loans.

The outstanding objection will mean that until such time as the auditors have investigated the matter and have concluded that the agreements are vires, then they cannot issue the City Council with an audit opinion. When the matter has concluded satisfactorily then an opinion will be issued and this will be reported to Audit and Governance Committee at the appropriate time. ”

Sorry coucillors should read councillors.