When funds are not sufficient to run and maintain services or when there is the need to develop new infrastructure, Local Authorities need to borrow to cover their costs.

Local Government borrowing can be divided into:

- short term borrowing that is limited to a year and is usually used for revenue spending

- long term borrowing that can be for capital spending only (e.g. infrastructure) and theoretically cannot be borrowed more than 3 years in advance of need

According to current official figures for 2013-14, Local Authorities’ debt totals £85.1 billion, of which 99.4 % are long term loans. 1

As when an individual or a business needs to borrow funds, Local Government will need to agree with the lender a series of terms, such as:

- how much they will borrow (principal)

- for how long (maturity)

- how the repayments will be scheduled (repayment intervals)

- what interest they will pay (interest rate)

- what happens if the borrower wants to pay back the loan in full sooner than expected (breakage cost)

- what happens if the borrower fails to meet their legal obligations (default)

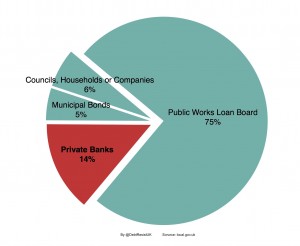

The decision to borrow must be taken by the full Council and it may borrow from any willing lender. In practice Local Governments borrows:2

- from Central Government via the Public Works Loan Board (75%)

- from private banks (14%)

- by issuing municipal bonds (5%)

- from other Councils, households or companies (6%)

The Public Works Loan Board (PWLB) offers two types of loans:

- Fixed rate loans, for which the maximum repayment period is 50 years and on which the rate of interest is fixed for the duration of the loan. Repayments for fixed rate loans are due at half-yearly intervals.

- Variable rate loans, for which the maximum repayment period is 10 years, and on which the rate of interest may be varied at one, three or six month intervals. Repayments are made at intervals corresponding to that selected for the variation of the rate. Once an interval is chosen, it remains unchanged throughout the life of the loan.

Some Local Authorities also issue municipal bonds. Bonds allow Councils to raise substantial sums of capital immediately, but can be risky if the Local Authority becomes unable to repay the bonds when they mature. Inability to repay bonds was one of the (many) causes of the recent high-profile bankruptcy of Detroit City Council.

Municipal bonds were used regularly throughout the early and mid-20th century, but fell into disuse during the 1970s and 1980s, when the PWLB became the main source of borrowing. The ability to issue bonds regularly is currently available to only a handful of Authorities. The Greater London Authority (GLA) and Transport for London (TfL) have issued bonds in the last few years, but not Councils. The GLA and TfL have access to substantial revenue streams compared to most Local Authorities, so their borrowing capacity is significantly higher. 3

From April 2015 Local Authorities also have the option to borrow from the Local Capital Finance Company (LCFC) a Municipal Bonds Agency 4 which aims to become an intermediary for:

- raising money on the capital markets through issuing bonds;

- arranging lending or borrowing directly between Local Authorities;

- sourcing funding from other third parties such as banks, pension funds and insurance companies.

The LCFC aims to lend to Councils at a lower rate than either the PWLB, or other Councils if they were to issue their own bonds. Priority for borrowing from the agency will be given to those Councils that are shareholders in the company, while non-shareholders will be charged a premium to borrow.

There is another form of financing used in Local Government called Private Finance Initiative (PFI) that involves setting up a partnership with the private sector to finance, construct and maintain public services. PFI financing is complex, both in the way it is set up, it uses complex derivatives, and it impacts local government finances. We will not cover PFI finance here, as we intend to dedicate a specific pamphlet to this topic, so all data we refer to will exclude this kind of debt.

For borrowing from private banks see the next section on LOBO loans.