On Tuesday 07 November, Newham Mayor Sir Robin Wales was questioned by BBC London about the Borough’s ranking as a household debt spot – labelled the “UK’s Debt Capital.”

Sir Robin Wales attempted to explain away Newham’s shocking debt position, as a natural consequence of the decline of the Newham Docklands, which hit working class communities in London’s East End particularly hard from the 1960s.

But are there other causes, such as chronic under-investment in quality social housing, low wages and a history of support for gambling – causing indebtedness, which link back to Newham Council’s economic, social and welfare priorities?

1) Poor Housing and Low Pay are the Key Issues in Newham

LSE’s 2014 ‘Facing Debt’ report – suggests high housing costs and instability along with unstable, low wage employment are the major issues facing Newham residents. Median net household income in Newham was just £15,704 (in 2014) compared to a national median of £22,204. Housing is a dominant problem in Newham, and across London, but the level of poverty and low income in Newham make pressures on the poorest particularly acute. Share of Newham owner occupiers has fallen (43% in 2001; 28% in 2012) along with the share of social housing tenants (37% in 2001; 34% in 2012).

2) The London Borough of Newham is NOT a Living Wage Employer?

Newham Council is NOT a living wage employer. An analysis by the Child Poverty Action Group found just 13 local Newham businesses pay a living wage. Businesses are more likely to register as living wage employers when the local council sets an example.

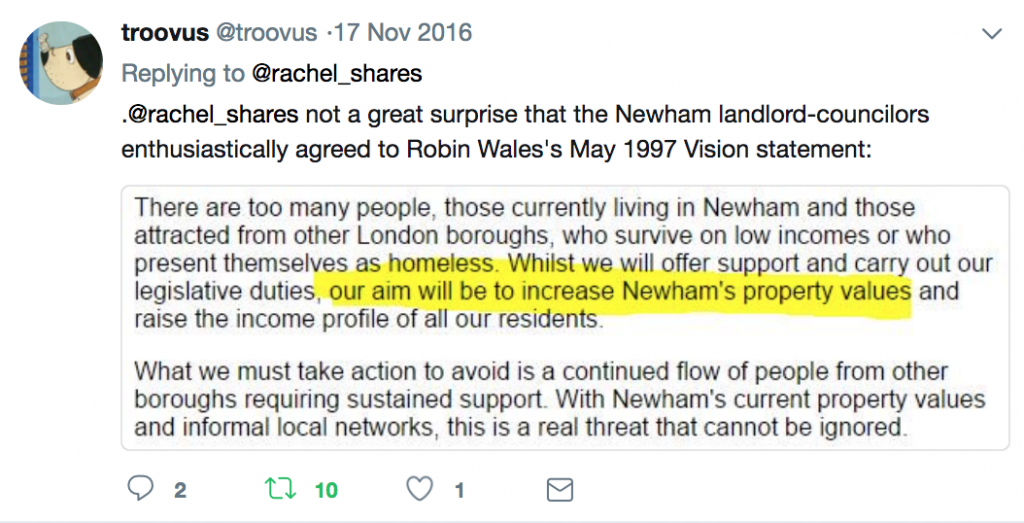

3) Unaffordable Housing Not Just About Cuts or Market Failure. It was Mayoral Policy

Newham Mayor Sir Robin Wales stated policy (1997) was to increase house prices in Newham. According to the Guardian, Newham has since seen the UK’s biggest house price rise (2015).

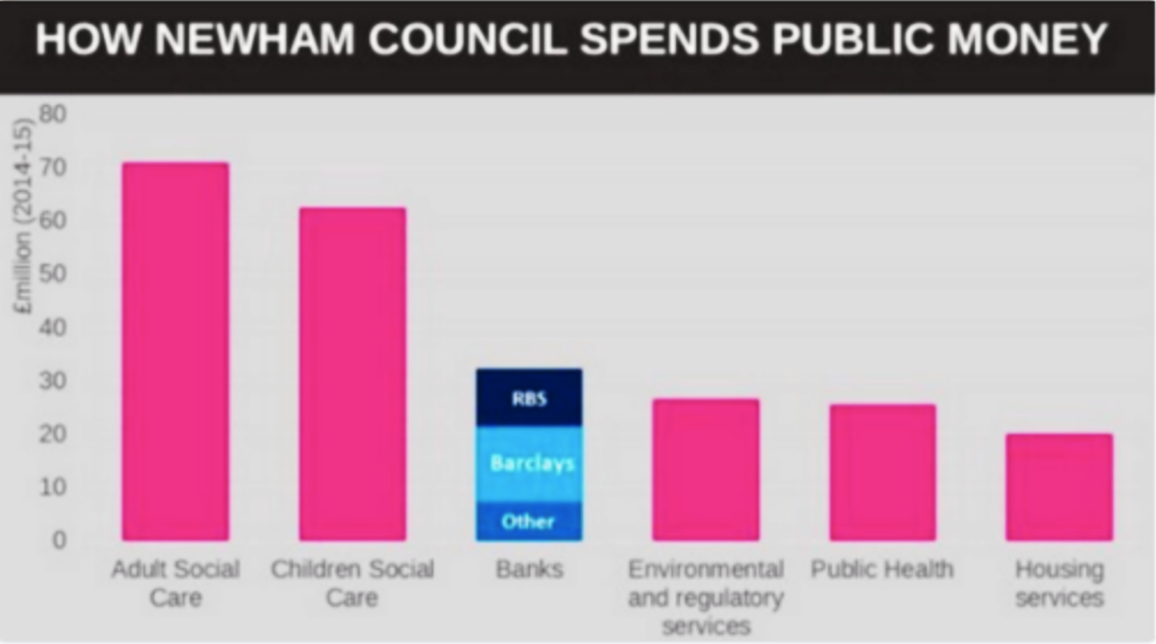

4) Spending on Social Housing in Newham has Declined Approximately 50% since 2010

Housing spending in 2009/10 was Gross = £419m // Net = £20.8m. A direct comparison of housing spending in 2016/17 is not possible, as Newham has reclassified housing spending into a broader “Community Infrastructure” category, totalling just £10.7m. Total Newham spending on council services was cut by 27% since 2010. Despite Housing being a top 3 priority for Newham residents, council spend significantly less money on housing than bank LOBO loan debt repayments.

5) One in Every 25 People In the London Borough of Newham is Homeless

Newham’s Homelessness rate (one person in every 25) is the highest in England.

6) Newham has highest debt per person of any London borough & pays the highest interest rates in the UK

Newham Council borrowing increased from £937million in 2010 to £1.67 billion in 2017 (to £5416 for each person in the borough). Annual spending on interest repayments increased from £54m (2010) to £83m 2017 – now equivalent to 125% of council tax – the highest in England. Newham has the most bank LOBO loans (£563m) of any council in the UK.

7) More than 1500 Newham Residents received a visit from Bailiffs in 2016 over unpaid Council Tax Debt

According to data obtained by the Child Poverty Action Group, Newham Council called Bailiffs to recover overdue council tax (+collection costs) on 1560 residents in 2016.

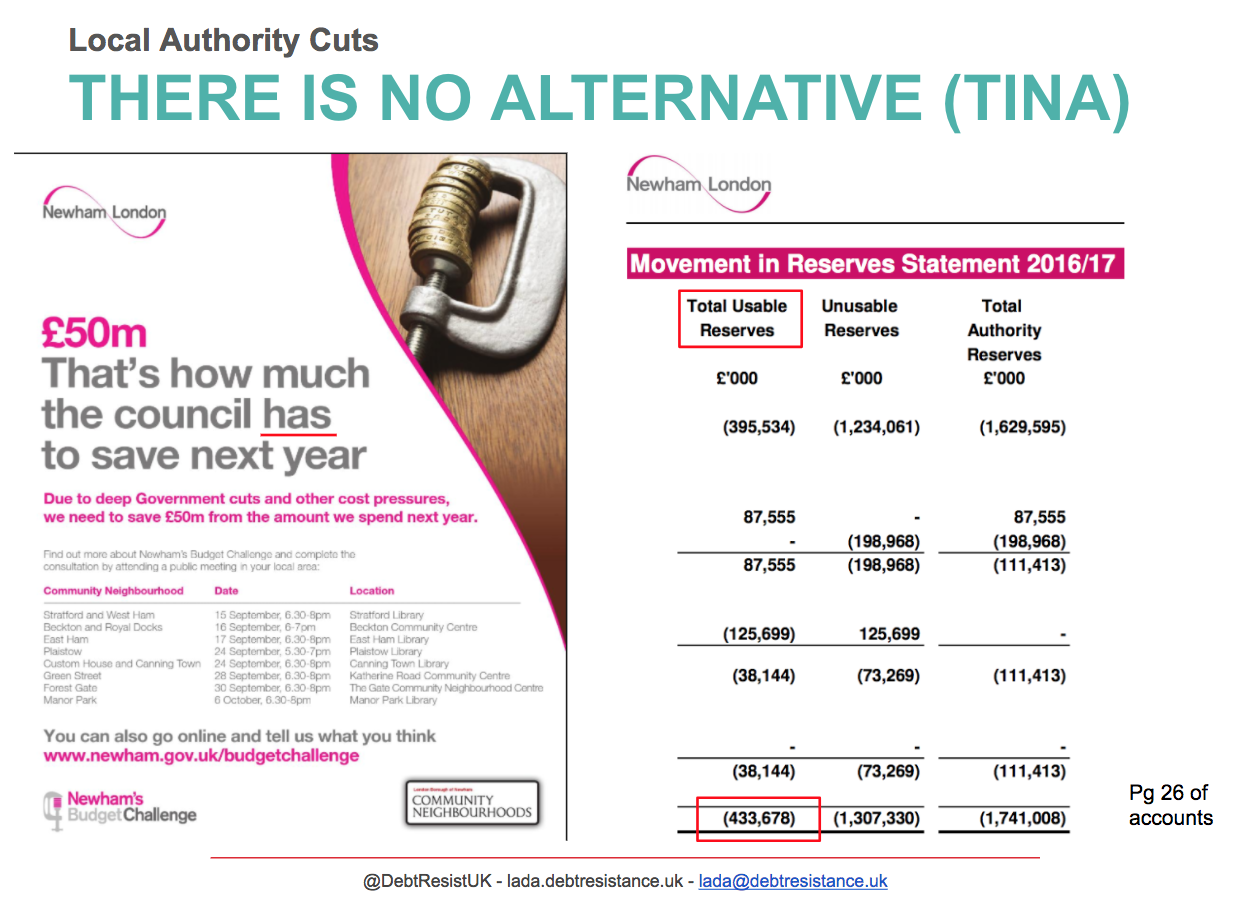

8) Newham Council Reserves have Increased 560% since 2010 – While Council Has Been Making Cuts

Newham Council’s “useable reserves” have increased from £77m in 2010, to £434m in 2017 – while cutting £50m a year in spending on services over this period?

9) Newham is a Gambling Mecca – and the Council is Financially Reliant upon the Industry

Newham is a Gambling hotspot – including High Street North (E12) where gamblers spent a London high of £3m on fixed odds betting terminals described by Matt Zarb-Cousin of the Campaign for Fairer Gambling as the “crack cocaine of gambling.” Aspers Casino – the largest casino complex of its kind in the UK – is located within Westfield Shopping Mall, from which Newham council receives income of around £1m per year in takings.

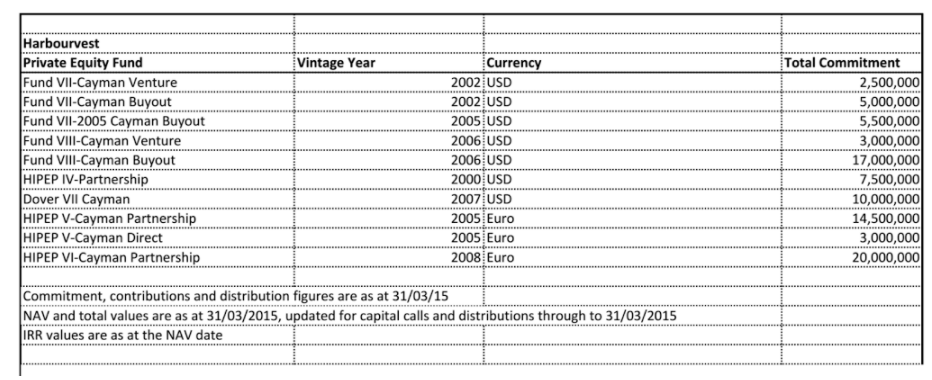

10) Newham’s Pension Fund Invests In Cayman Island Hedge Funds

Rather than investing in local, let alone UK based businesses, an FOI response in 2015 revealed that Newham Council’s Pension Fund had £88 million invested offshore in Cayman Island registered Private Equity funds.

Posted in Blog