A July 6th Dispatches programme on Channel 4, itself based on research conducted by Debt Resistance UK and independent financial experts, brought to national attention the fact that many UK councils are stuck paying high interest rates to banks on money they’ve borrowed.

Since then we’ve heard responses from the Local Government Association and from local authorities themselves where they defend LOBO loans as ‘legitimate financial instruments’ and where they complain that the documentary was ‘one-sided’. In one quote which was fairly dripping with condescension Conrad Hall, chief finance officer at London Borough of Brent (LOBO loans outstanding £95.5m) accused Dispatches of not getting to grips ‘with what is an admittedly technical subject’.

In an attempt to simplify things for Conrad Hall, and a wider audience, here’s a series of blog posts which explain why LOBO loans to local councils are a rip-off, presented in non-technical language.

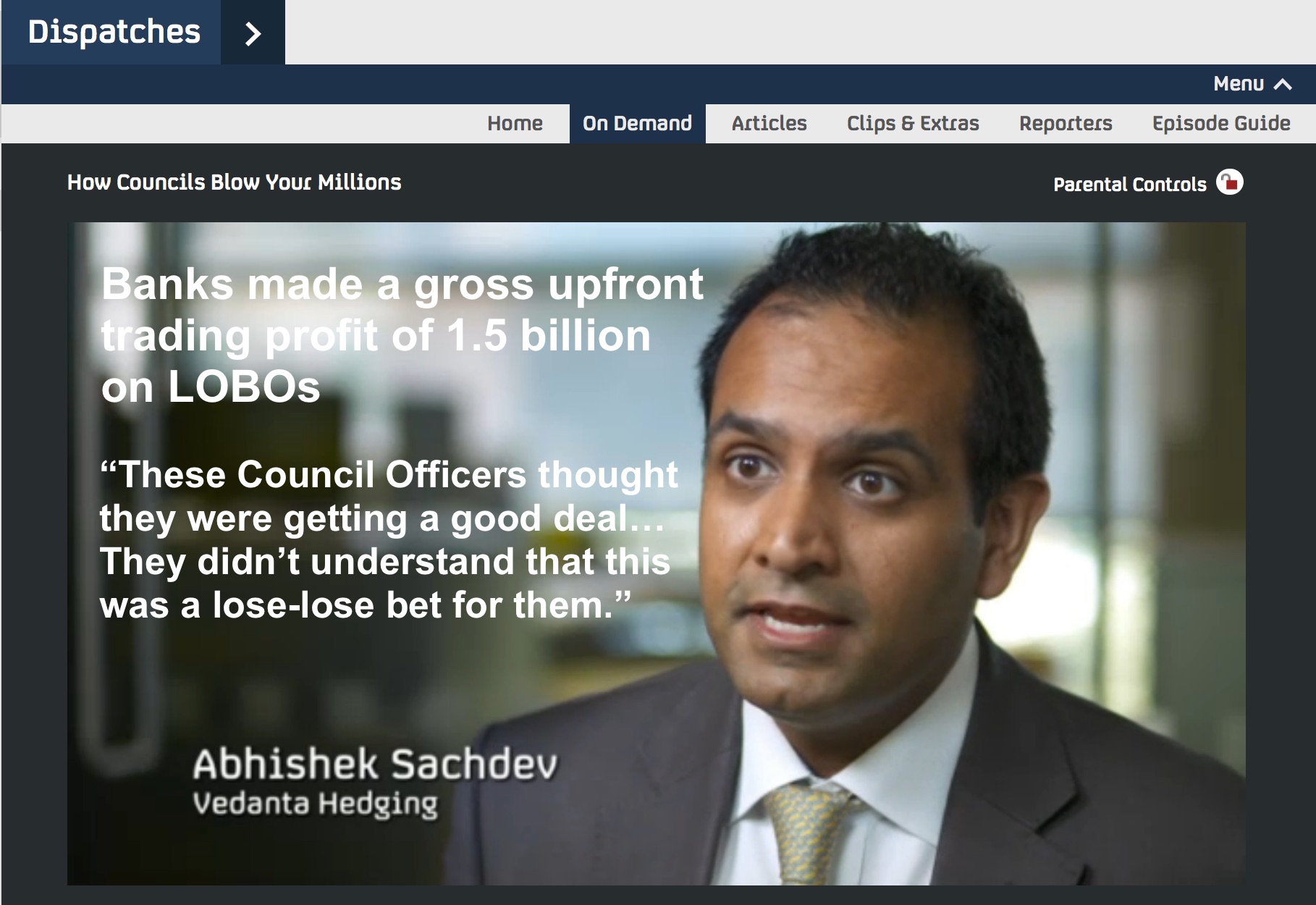

This post owes a debt of gratitude to Rob Carver, former trader at Barclays Capital, and Abhishek Sachdev, CEO of Vedanta Hedging, who have both done a great deal to explain how council finance chiefs have been taken for a ride with LOBO loans, and have both given evidence to an ongoing parliamentary inquiry.

1. LOBO loans are a lose-lose bet for councils

Councils sometimes need to take out long-term loans to pay for big projects like building homes or schools. Anyone who’s taken out a mortgage knows how this feels. They’ll also know that there are, in general, two kinds of long-term loan: a fixed rate loan and a variable rate loan.

With fixed rate loans the borrower pays a set amount of interest for the length of the contract, so if interest rates go up during that time they win and if interest rates go down they lose.

With variable rate loans the interest rate a borrower pays changes as interest rates in the wider world change. So if interest rates go down they win and if interest rates go up they lose.

Unlike households, which generally only have one mortgage, a council will have lots of long-term loans on the go at the same time. Nobody really knows what’s going to happen to interest rates so it makes sense for a council to have some fixed rate loans and some variable rate loans. That way if interest rates go up they win on some loans and lose on others and vice versa if interest rates go down.

The biggest source of long-term loans to councils in the UK is the Public Works Loan Board, a government body which is part of the Treasury and which offers fixed rate and variable rate loans to local government. So with PWLB loans a council can maintain a good mix of fixed rate and variable rate loans so that it doesn’t lose out too much if interest rates go up or down.

How boring, you might think. Well quite. Finance is boring. That’s why bankers are always bending over backwards in an attempt to sex it up. To try and sex up local authority finance bankers invented LOBO loans.

A LOBO loan, at first glance, looks just like a fixed rate loan that a council would take out from the PWLB, except that it’s from a bank. The council borrows a lump sum of money and pays interest at a fixed rate at regular intervals until the loan expires and the council has to pay back the original sum. So far, so boring.

Here comes the sexy part. The critical differences with LOBO loans are:

- they usually last much longer than PWLB loans, sometimes as long as 70 years;

- the initial interest rates are always lower than that offered by the PWLB;

- written into the contract is an option for the lender to change the interest rate at regular fixed intervals.

That’s right: the bank can change the interest rate. Sounds dodgy doesn’t it?

‘Ah, but,’ a hypothetical council finance chief (let’s call him Holland Car) might say, ‘if the bank were to put the interest rate up the contract also allows the council to pay off the loan early without any fees. So if the bank put the rate up we could just pay off the loan and take out a new loan from the PWLB.’ Which is true. So what’s the problem?

In order to see the problem we have to imagine two different scenarios: one where a hypothetical council (let’s call it the London Borough of Bernt) takes out a LOBO loan and then interest rates go down; and one where Bernt takes out a LOBO loan and then interest rates go up.

When interest rates fall

Bernt has taken out a LOBO loan at a fixed interest rate of 3%, a bit lower than the rate on offer from the PWLB. Holland Car feels smug because he thinks he’s saved the council money.

Then interest rates fall. The new rate on offer from the PWLB is lower than 3% but Bernt can’t get out of the LOBO loan contract (at least not without paying a huge early repayment fee) so it’s losing out. This is exactly what happened when interest rates plummeted to near-zero after the financial crisis. All the councils with LOBOs were left paying interest on those loans at pre-crisis levels.

But the same thing would have happened if Bernt had originally taken out a fixed rate loan from the PWLB, so it’s no biggie. After all, interest rates will sooner or later rise again…

Outcome: small to medium sized loss.

When interest rates rise

Bernt has taken out a LOBO loan at a fixed interest rate of 3%, a bit lower than the rate on offer from the PWLB. Holland Car feels smug because he thinks he’s saved the council money.

Then interest rates rise. The rate on offer from the PWLB goes up. Holland Car still thinks he’s saved the council money but he’s starting to sweat because the bank’s next opportunity to put up the rate on the loan is fast approaching. The bank puts up the rate. But, instead of putting the rate up to the same level as the new PWLB rate, the foxy bank puts the rate up to just under the new PWLB rate.

What does Holland Car do? It doesn’t make sense to pay off the LOBO loan and take out a new loan with the PWLB because the interest rate on the LOBO is still lower than what he could get now. So he sticks with the LOBO.

Interest rates rise again. The same thing happens. Holland Car sticks with the LOBO.

Interest rates fall. (This might not happen for a long time but remember, LOBO loans last for up to 70 years. And what goes up…) The bank does nothing. It has no incentive to change the rate now since the council has no way out of the contract. The council is left paying just under the highest interest rate that existed during the life of the loan for the rest of the life of the loan, no matter how far interest rates might ultimately fall.

Outcome: huge loss.

So no matter whether interest rates rise or fall the outcome is bad for the local authority and good for the banks.

Unless, and this is the only situation in which a LOBO loan is a good deal, the council is certain that interest rates will remain within a very narrow range for the next 5 to 7 decades.

And if you look out of the window now you might just see Holland Car zipping past on a flying pig.

In the next post I’ll dive into two more reasons why LOBO loans to local councils are rip-offs: they suck money out of the public sector into the pockets of bankers; and they’re more expensive to arrange than loans from the PWLB.

Posted in Blog