Debt Resistance UK is providing information and support to local residents wanting to take action against LOBO loan mis-selling and austerity cuts in their Borough, exercising rights under the Audit Commission Act to challenge items of irrational or illegal spending in the Councils annual accounts.

DRUK has provided a guide for people wanting to take action on LOBO loan debt here:

A second Audit Commission Act objection has now been raised against LOBO loan borrowing at the London Borough of Tower Hamlets (host of the Canary Wharf financial district, and Barclays HQ) in regard to their 2014/15 annual accounts by local resident Angus McNelly.

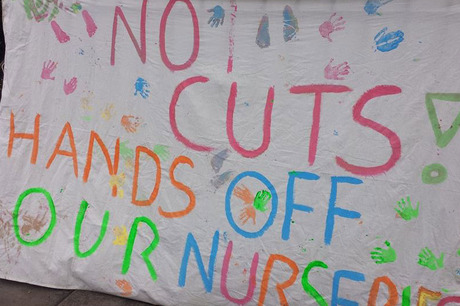

Resident Statement – Angus McNelly: “The debt of Tower Hamlets Council, in the form of LOBO loans, highlights some of the biggest problems of our current financial system. We have one of the country’s poorest boroughs implementing spending cuts of £30 million and council tax hikes; whilst at the same time they are being forced to pay over the odds for debt repayment that is linked through financial instruments to the vicissitudes of the market. Not only is a taxpayer funded council being shafted by a bank bailed out by the tax payer (RBS), but both the lenders Barclays and RBS were recently fined for fixed the LIBOR rate on which these loans are benchmarked.

I feel strongly that the good of the people of Tower Hamlets and the council’s financial security has to come before the profits of big banks.”

Text of Objection Letter:

As an elector of the London Borough of Tower Hamlets, I wish to lodge an objection to the accounts prepared for public inspection by Council for the year 2014-2015. I request that KPMG issue a report on these accounts in the public interest and transmit it to the Council.

I wish you to issue this report on the grounds that taking out Lender Option Borrower Option (LOBO) loans was unlawful. Additionally, I request that you apply to the courts for a declaration that item(s) of the accounts, namely LOBO loan borrowing, is unlawful.

The term ‘unlawful’ applies in this context, I believe, because the decision to sign up to LOBO loans from the Royal Bank of Scotland and Barclays was irrational.

I am concerned that the terms of the LOBO contracts and their implications were not sufficiently understood by council officers; and that the volume and type of borrowing carried such a high risk as to be prejudicial to the interests of Tower Hamlets taxpayers.

The legal status of LOBO loan use is the subject of significant legal ambiguity and debate. Following the 1989 Hazell vs Hammersmith and Fulham [Goldman Sachs] case, derivatives use was declared “ultra vires” or illegal, for UK local government.

By inserting derivatives into a LOBO loan, it is clear banks intentionally subverted the intent of such protections, to “engineer” around the law.

The London Borough of Tower Hamlets borrowed £77.5m in the form of LOBO loans between August 2007 and September 2009, refer to Section 15, pg 38- 41 [Financial Instruments] of the 2014/15 annual accounts.

The loans are with Barclays (£17.5m) and RBS (£60m) which means that the Borough, which is home to some of London’s most deprived areas, and where the Council has just signed off on £30m spending cuts alongside a 4% hike in council tax rates, is paying over £3.5m in interest per annum to the owners of One Churchill Place, Canary Wharf and the former owners of 5 Canada Square, Canary Wharf.

The accounts make note of the fact that: “In the more than 10 years [i.e. long term borrowing] category, there are £77.5 million of Lender’s Option, Borrower’s Option (LOBO) market loans, of which £17.5 million have call dates in the less than one year category. The Council uses money market funds to provide liquidity.”

Tower Hamlets are forced to keep treasury reserve cash on hand, to meet annual call options on LOBOs to repay without penalty, should the bank exercise its option to raise interest rates.

It is my view that taking out loans of this type and magnitude constituted a gamble: namely that the Council would gain a short-term benefit if interest rates continued to rise.

However, this did not occur – partly as the result of systemic downward LIBOR interest rate manipulation (“low-balling”) by Barclays and RBS, which sold Tower Hamlets LOBO loans.

Abhischek Sachdev, CEO of Vedanta Hedging described LOBO loans to the Communities and Local Government Committee inquiry hearing on local government bank loans as a “lose-lose bet for councils.”

Legal opinion regarding LOBOs from City law firm Collyer Bristow states: “if market rates for equivalent lending remain low (and lower than the rate to be paid under the LOBO) the borrower is effectively locked in for the full term – it has no option to exit the arrangement and seek cheaper borrowing elsewhere – it must live with the rate agreed at the time the LOBO was entered into. So from the borrower’s perspective, these loans are a very long term commitment to pay the rate agreed at the outset for a term, or higher. So, on the face of it, the borrower is in a “lose/lose” position.

I believe that making such a borrowing commitment under the conditions which the banks imposed, without benchmarking and recording the decisions against comparable PWLB loans or seeking external financial advice, amounted to ‘irrational’ conduct.

Treasury Management Advisor, CAPITA who recommended LOBO loan products received kickbacks (undeclared to council), when loans were brokered by Tullet Prebon and ICAP.

Treasury Management Advisors, operating under the Chartered Institute of Public Finance and Accountancy (CIPFA) framework, recommend councils borrow no more than 30% of long term debt in ‘inherently risky’ (refer April 2015 CIPFA bulletin), variable rate, LOBO loans.

Tower Hamlets, by comparison, has 87% of its long-term debt in variable rate LOBOs.

This compares very unfavourably with other London Boroughs. Figures obtained by FOI requests on LOBO loan borrowing show that the mean portion of overall long term borrowing in the form of LOBO loans is 16% for London boroughs. The median is just 3.3%.

I would therefore be grateful if you considered this request to issue a public interest report on Tower Hamlets LOBO loan borrowing for the year 2014-2015, and request that you apply to the courts for a declaration that item(s) of the accounts, namely LOBO loan borrowing, is unlawful.

Yours sincerely

Angus McNelly

Posted in Blog