Debt Resistance UK is providing information and support to local residents wanting to take action against LOBO loan mis-selling and austerity cuts in their Borough, exercising rights under the Audit Commission Act to challenge items of irrational or illegal spending in the Councils annual accounts.

DRUK has provided a guide for people wanting to take action on LOBO loan debt here:

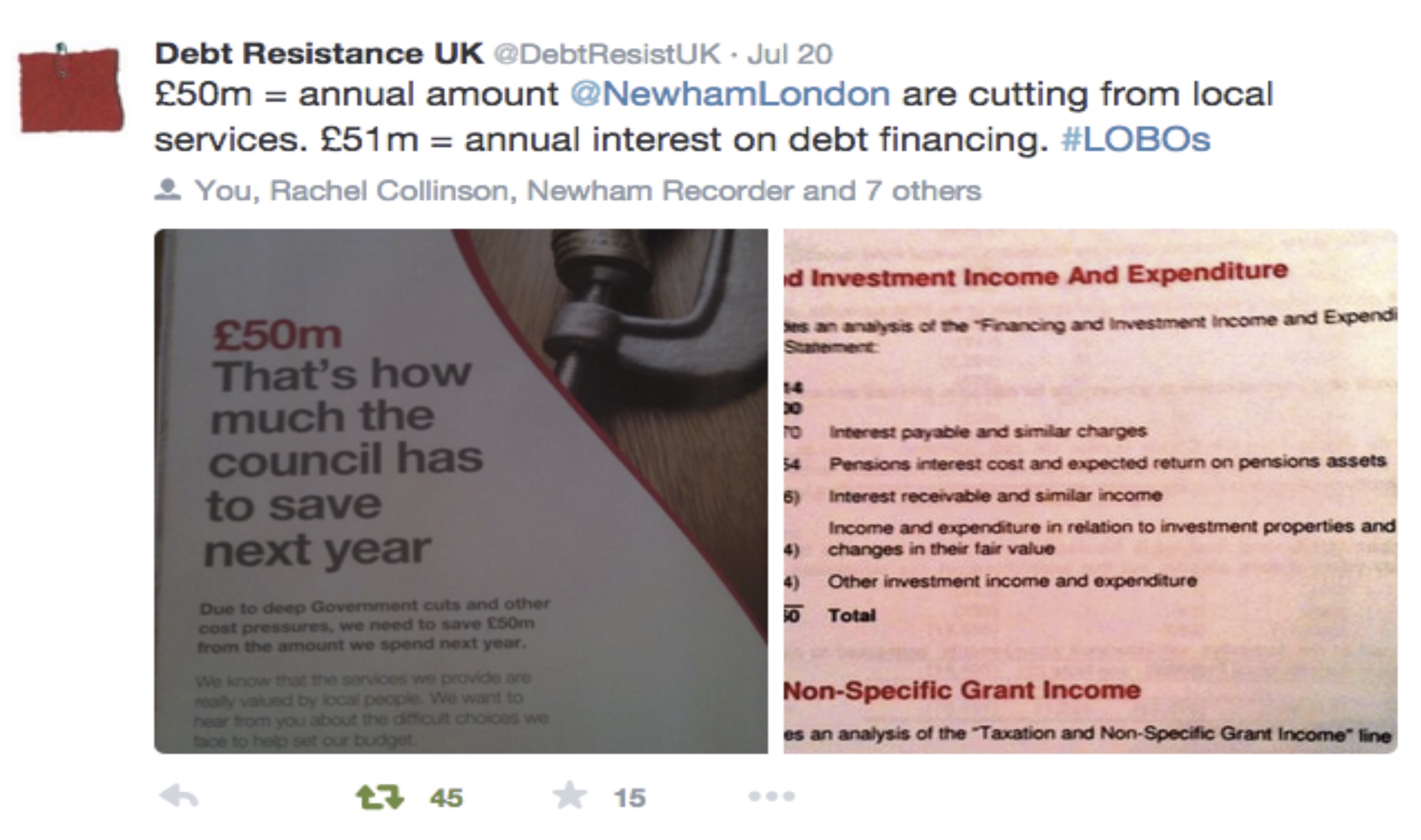

The first Audit Commission Act objection raised against LOBO loan borrowing is at the London Borough of Newham (the UK’s largest LOBO borrowing in regard to their 2014/15 annual accounts by local resident Rachel Collinson.

Resident Statement – Rachel Collinson: “I have been taking action against LOBO loans in Newham, as I consider it a matter of social justice which clearly demonstrates the warped priorities of this local authority. Council leaders are wringing their hands of responsibility for austerity cuts, while slashing social services. The LOBO loan scandal demonstrates there are alternatives and Newham Council don’t have to cut.

If Newham Council followed the lead of London housing associations and challenged the banks on what appears to be a clear case of LOBO loan mis-selling, we could lift this painful debt burden from the backs of some of the UK’s poorest people here in Newham.”

Text of Rachel’s Objection Letter:

As an elector of the London Borough of Newham, I wish to lodge an objection to the accounts prepared for public inspection by Council for the year 2014-2015. I request that you apply to the courts for a declaration that item(s) of the accounts, namely LOBO loan borrowing, is unlawful.

The term ‘unlawful’ applies in this context, I believe, because the decision to sign up to so many (27) of the LOBO loans (and in particular the RBS “inverse floater” and Barclays “range LOBOs”) was unreasonable and irrational. The potential costs and derivatives risks of the LOBO loan contracts were not, and could not, be fully understood by council officers, and the type and volume of borrowing carried such a high risk as to be prejudicial to the interests of Newham Council tax payers.

In July 2015, Newham LOBO loan borrowing was subject to a C4 Dispatches documentary: “How Councils Blow Your Millions” and is the subject of a Parliamentary Inquiry by the Communities and Local Government Committee.

Newham Council borrowed the sum of £563.5 million in LOBO loans [refer to item 51. of the accounts, pg 97], including £238 million via Barclays Bank in range LOBOs and £150 million with the Royal Bank of Scotland in the form of ‘inverse floater’ LOBOs, signing 27 loan contracts between 2002 and 2010. Taking out loans of this type and magnitude constituted a gamble that the Council would obtain a short-term benefit, if interest rates continued to rise.

I believe that making such a large borrowing commitment under the conditions which the banks imposed, without benchmarking and recording the decisions against comparable PWLB loans, or seeking external financial advice, amounted to “irrational” conduct.

Newham LOBO loan contracts were denied to councillors on the basis that the contracts were “commercially sensitive.” This raises serious concerns about councillors’ access to financial information that materially affects their ability to carry out democratically mandated scrutiny functions.

Based on an assessment of the LOBO loan contracts (which were denied via FOIA and I was only able to obtain via use of the Audit Commission Act), financial analyst Nick Dunbar (who accompanied me to inspect the accounts) calculated the additional cost of LOBO borrowing to be in the vicinity of £10 million, at a weighted annual interest rate of 5.7%, the second highest in the country. The total repayment cost for Newham to exit the LOBO loan portfolio is in excess of £1.2billion.

Treasury Management Advisors operating under the Chartered Institute of Public Finance and Accountancy (CIPFA) framework recommend councils borrow no more that 30% of long term debt in “inherently risky” [refer April 2015 CIPFA bulletin] LOBO loans.

Newham, by comparison, has borrowed in excess of 90% of its debt in variable rate LOBOs.

This compares very unfavourably with other London Boroughs. Figures obtained by FOIA requests on LOBO loan borrowing show that the average (mean) portion of overall long term borrowing in the form of LOBO loans is 16% for London boroughs. The median is just 3.3%. To give additional context, Newham has the second highest long term debt burden among London Boroughs (Croydon, with £714m, has the highest).

Excessive LOBO loan borrowing has perverse implications for the amount of “Treasury Cash Reserves” Newham must keep on hand, in order to repay the LOBO loans without penalty, should the banks exercise their option to increase the interest rates.

Correspondence between myself and Grantley Miles, the former Newham Acting Chief Accountant suggests £213m of Newham’s declared £313m Treasury Reserves is, in effect, money set aside specifically to repay high interest rate LOBO borrowing, should the loans be ‘called’ by the banks.

In response to issues raised regarding LOBO loans, Newham’s Mayor, Sir Robin Wales, stated during a Full Council Meeting on the 7th December 2015 that “Newham obtains the highest interest rate return on its investments of any local authority in the UK.” What this also means is that Newham is taking the most investment risk.

As was painfully learnt during the Icelandic banking crisis, where £1bn of taxpayers money on deposit by councils was lost, interest rate returns are the inverse of credit risk.

I note however that there is very little practical information on investments in the published Newham accounts, upon which to base an accurate assessment of Newham’s borrowing and investment approach and risk appetite.

Robin Wales’ public statement suggests that the investment approach of Newham’s Treasury Investment funds may contradict agreed CIPFA Treasury Management objectives (in order of importance): 1) Security, 2) Liquidity, 3) Yield, as set out in item 3.3.1 of Newham’s Treasury Management Strategy, and may be placing taxpayer funds at unacceptable risk, in an era where unsecured local government bank deposits are subject to bank bail-in.

I would therefore be grateful for you to apply to the courts for a declaration that Newham Council’s LOBO loan borrowing for the year 2014-2015 is unlawful, noting associated investments may also be in breach of the CIPFA Treasury Management Prudential Code.

Yours faithfully

Rachel Collinson

Posted in Blog

2 thoughts on “Newham resident calls for High Court declaration over “irrational” Barclays and RBS LOBO loan borrowing”